The objective of this post (whose title is likely to ring a bell with rock enthusiasts) is to provide our readers with a brief update on the markets which we follow and in which we currently hold positions. It is not difficult to surmise that we’re not busy popping bottles of Pétrus to celebrate our winnings. As contrarians, we’re accustomed to coppering the public’s bets and we’re also used to being early and to suffering drawdowns that generally last anywhere from a few weeks to a few months. We rarely have the pleasure of picking exact tops and bottoms. We have however to admit that this time around the stubbornness with which the various markets persist in following their current trends is nothing short of amazing. This can either mean that A) we’re spectacularly wrong on all our major calls so far; B) for once in their lifetime, the herd is being granted by the market’s gods the privilege of being right in spades; C) the degree to which the current trends are being overstretched is going to guarantee equally strong and long-lasting trends in the opposite direction. We’ll let our readers make their own choices re the above.

Precious Metals

Since our analysis of the sector dated the 13th of February and our More-on trades of the 26th of February and the 6th of March, Gold experienced a crash of historical proportions and Silver did its best to keep up Gold’s pace.

As we mentioned we were alert to the possibility of a final washout of weak hands, although we must admit we weren’t expecting such an effective cleansing. However “shit happens” in the markets as well. We aren’t concerned in the slightest that the fundamental, long-term trend is over: we consider this correction to be just part and parcel of a secular bull market and the longer and more severe it is, the better. Those who sell in a panic always have the opportunity to regret it and those claiming that during the ‘70s Gold halved in price and that as such it now has to go below 1.000$/oz. forget the different dynamics of the last bull market and the fact that Gold experienced a much stronger advance in a much shorter timeframe, thanks to the fact that it had just begun to trade freely. As a basis for comparison, please consider that during the same period Silver (which was already trading freely and which of course has a higher beta than Gold) declined roughly the same percentage: a testament to how overbought gold was.

That said there are more than a few facts and factoids that point to the possibility that a major low has just been printed (or that at least a remarkable window of opportunity has opened up). [A retest of said low may or may not occur: we don’t now and, quite honestly, we don’t care. In case it does, it’s guaranteed to scare most people shitless.]

Here are some of them, in no particular order of importance:

- Record-high volume on GLD both on Friday and on Monday;

- Continued outflows from GLD notwithstanding a meaningful price recovery (those claiming that ETF selling is bearish and impacts the market need to remember that the total stock of gold roughly amounts to 170.000 tonnes vs. roughly 2.500 tonnes held by ETFs);

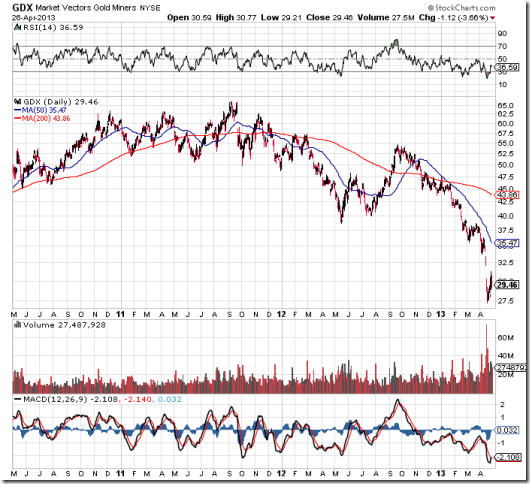

- Record-high volume in the GDX ETF;

- Record-high volume in the Gold futures market as well;

- Record-low readings on the Hulbert Gold Sentiment indicator and very low readings on the Sentimentrader Gold and Silver Public Opinion surveys;

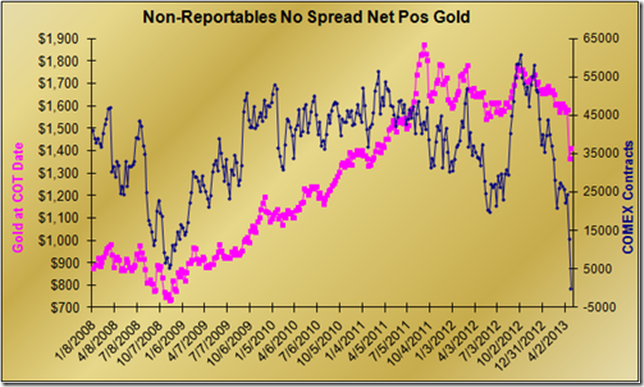

- Extremely good CFTC CoT reports for both metals for the week ending on the 26th of April, with Small Specs in Gold basically erasing their Net Long position. To quote Sentimentrader: “In gold, small speculators have gone from holding a net 60,000 contracts in October of last year, to very nearly being net short now for the first time since 2001. They've reduced their positions over the past two weeks more than any other two-week period since 1988.”;

- A flood of bearish articles, reports and recommendations appearing on a variety of prominent financial sites, newspapers and magazines.

And here are some charts that highlight the severity of the decline and the sheer volume that accompanied it:

Weekly Gold chart via Stockcharts. Notice the nice long “wick” at the bottom of the last red candle: it usually signals buying pressure and a bottoming process.

Weekly Gold chart via Stockcharts. Notice the nice long “wick” at the bottom of the last red candle: it usually signals buying pressure and a bottoming process.

A daily chart of GDX via Stockcharts: notice the staggering volume.

Daily Chart of GLD via Stockchats: you can observe that just a wee spike in volume took place here as well.

Weekly chart of Silver via Stockcharts: way less inspiring than Gold and yet some support can be detected there as well.

A chart showing the outright collapse in Small Specs’ positioning, via Gotgoldreport.com.

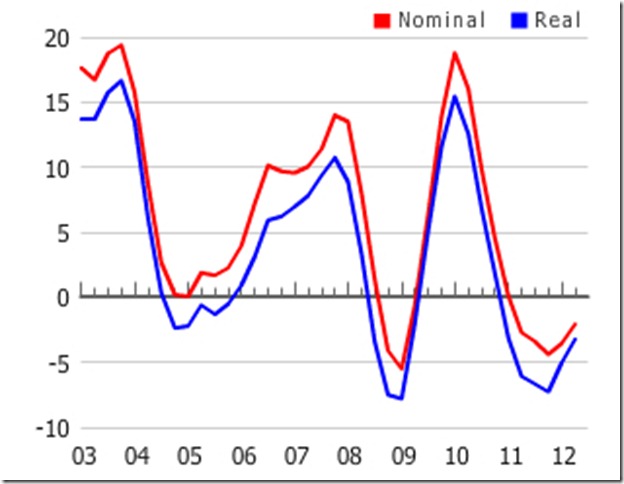

Softs

Both Sugar and Coffee have experienced further declines since our posts dated 14 January, 1 February, 26 February and 13 March. Fundamentals continue to remain decidedly bullish, in particular for Sugar, and sentiment and positioning are extremely favourable to the bullish case as well. An interesting development is the marked reduction in volatility in Sugar, as measured by the width of its Bollinger Bands: our experience is that this usually signals that a powerful trend is the makings.

A slow bleeding accompanied by a marked reduction in volatility: a powerful trend change may be in the offing. Otherwise, hold on to your hat, as we may see a repeat of the Gold near-death experience (extremely unlikely an yet still possible).

The decline of Coffee prices from their 2011 peak now amounts to almost 60%. As Pater Tenebrarum likes to joke, there’s no need to worry, as it exists strong lateral support at 0. More seriously, we have now retraced exactly 100% of the previous advance (you can see the breakout area at the far left of the above chart).

Yen

This is the market where the most interesting changes have occurred. Soon after taking on the role of BoJ Chief, the apparently inebriated Kuroda decided to double Japan’s monetary base on the spot. This may very well turn out to have killed the bullish case. We shall see. We just mention that risks continue to exist and actually abound in various currencies like the CAD and the AUD and that at least a decently-sized correction is likely to occur, to erase the oversold readings and the sentiment excesses. We hold long-dated options that have indeed turned out to prove effective in protecting us from ruinous losses.

Kuroda cheering at the thought of destroying an entire country, right after having smoked some good stuff. He also seems to need a dentist quite badly, a sign that he may very well be addicted to Meth.

A daily chart of the horribly oversold Yen: after a 30% decline in a bit more than 6 months a rally is just par for the course, even if the bear market were to continue. A double bottom may be in place.

Stocks

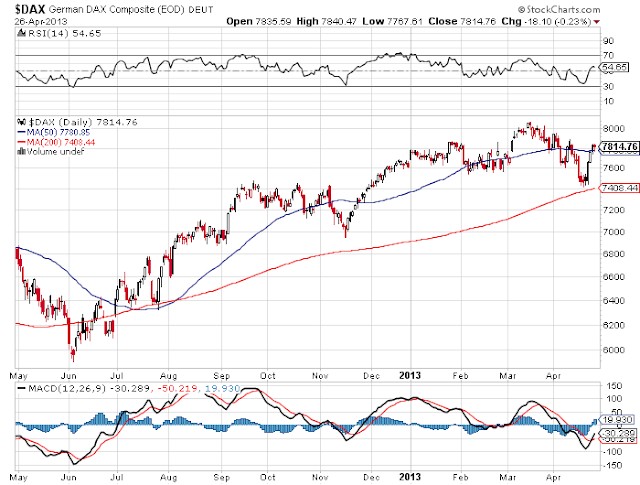

This is the market that is frustrating us the most. After all, PMs have been great performers for years on end and they’re now experiencing a run-of-the-mill cyclical bear market; Softs are also in the last and hence tricky part of cyclical bear and the Yen is now managed by a band of lunatics. But the stock market is now in the late stages of an extremely powerful cyclical bull market, with money printing that does nothing but create unsustainable bubble activities, with macro data that now obviously point towards a recession (in the U.S.: the rest of the world is already deep in doo-doo), with earnings that are now clearly deteriorating and with sentiment and positioning that have now been signalling for quite some time a speculative frenzy and yet it refuses to beak down. Each and every time it tries to do so, there you have support coming in and, presto, new highs are achieved. Not even the DAX can manage a half-decent decline. The only positive development we’ve seen so far is the recent increase in volatility and in daily ranges, something that usually accompanies the distribution process that takes place at a top.

A chart of the DAX: after tagging the 200-day SMA a bounce occurred and now we’re again above the 50-day SMA. The chart doesn’t look very bullish though.

Here we have the S&P500: it refuses to break down. Notice however how choppy the recent action has been: generally it is not a good sign when it occurs after long and powerful advances.

Conclusion

We need to exercise patience and wait for our investment theses to play out. The more the various markets keep going in the current direction, the more they’ll need to play catch up once the reversal occurs. The only notable exception may be the Yen, given that there’s now been a catalyst powerful enough to change the secular trend.