This is probably what many investors in the PM sector are currently yelling at their brokers. What we are witnessing in Gold and Silver these days is outright panic and forced liquidation due to margin calls. This is painful to endure, even for committed contrarians like us and even if the extreme nature of these events means that they usually last just a few days. But we know, from experience and costly mistakes, that these are the best of times in financial markets: weak longs liquidate, eager shorts pile in recklessly, sentiment gets smacked down and the collective psyche of the traders and investors is conditioned to expect nothing but weakness and lower prices. In short, it is during these tribulations that a new bull market is born. We won’t engage in long ramblings to convince our readers of the merits of investing in PMs. We’ll rather present a few charts that highlight the fact that an inordinate stampede is currently taking place. We’ll leave it to the informed reader to make his own observations and to determine whether the current crash is likely to continue or whether it is a “one-off” event that has the potential of getting reversed quickly and violently. Our only suggestion is to watch out for a large “wick” (i.e. a long tail at the bottom of a daily candlestick that is likely to signal the exhaustion of selling). We also note that all the charts are as of last Friday and that today is shaping up as another panic, which has the potential of being worse than Friday and with even larger volumes. Finally, this remembers us how come that leverage is not a good companion to a contrarian approach.

A chart of Gold: notice the sheer amount of contracts transacted on Friday. It seems likely that today we’ll see an even bigger figure: as of 11.00 GMT more than 220.000 contracts have been exchanged.

A chart of Gold: notice the sheer amount of contracts transacted on Friday. It seems likely that today we’ll see an even bigger figure: as of 11.00 GMT more than 220.000 contracts have been exchanged.

Same goes with the ETF GLD: roughly 55 million shares changed hands on Friday: one of the largest volumes ever. It’s worth noting that the amount of gold being held by the ETF has been steadily and steeply declining in the last quarter.

The chart of Silver is no different: almost 100.000 transactions took place on Friday.

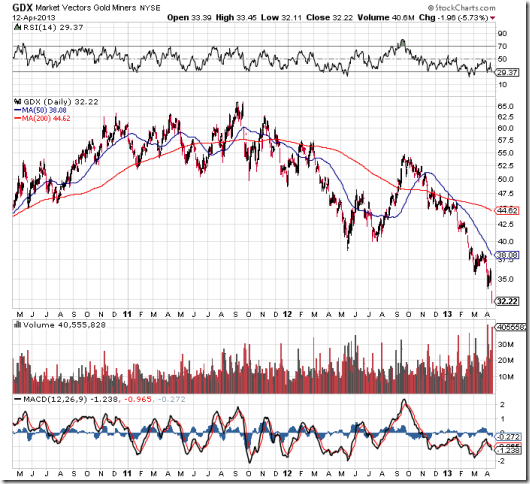

The ETF GDX has also seen massive capitulation volume. A suggestion to current holders: brace yourself, as today may turn out to be a nightmare.

A chart of Gold: notice the sheer amount of contracts transacted on Friday. It seems likely that today we’ll see an even bigger figure: as of 11.00 GMT more than 220.000 contracts have been exchanged.

A chart of Gold: notice the sheer amount of contracts transacted on Friday. It seems likely that today we’ll see an even bigger figure: as of 11.00 GMT more than 220.000 contracts have been exchanged.

No comments:

Post a Comment